18 Dec 2024

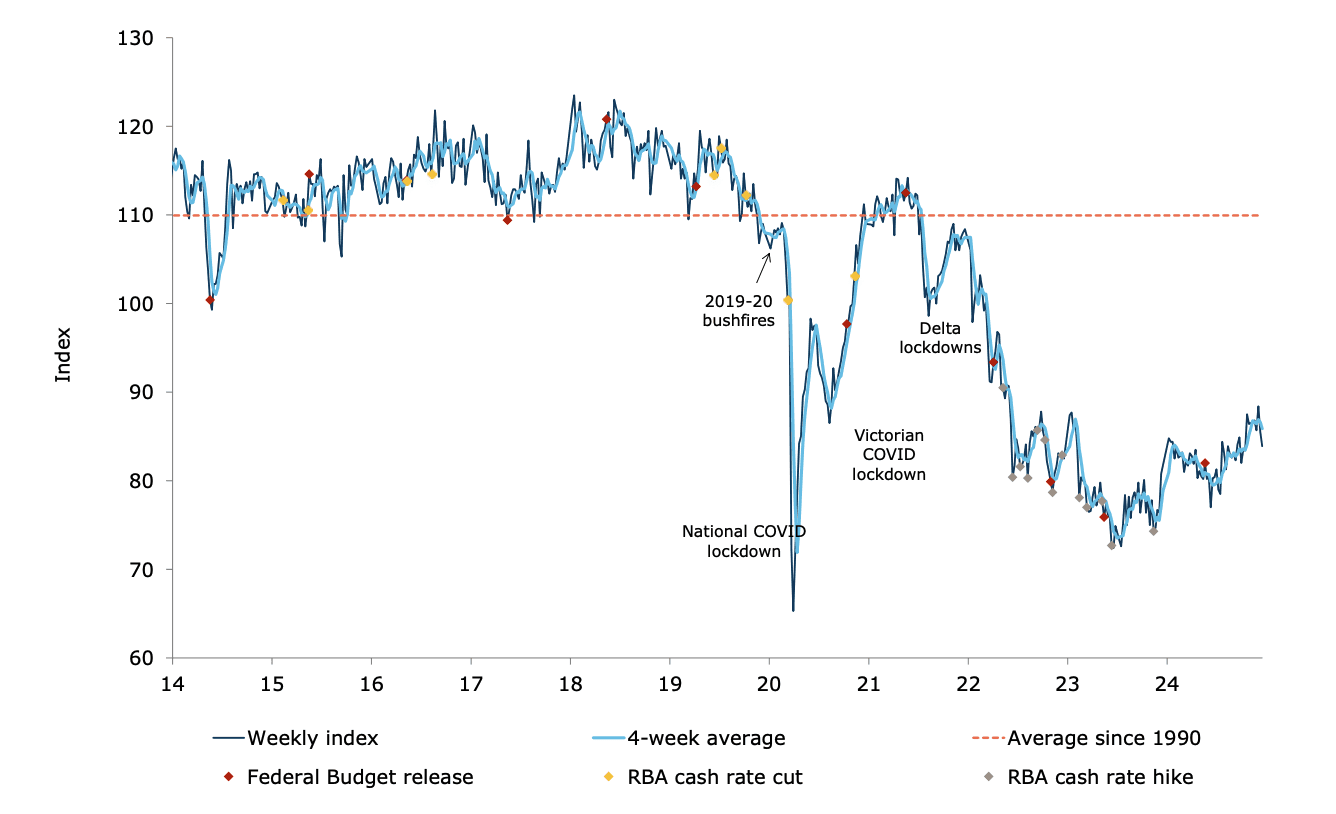

Today’s ANZ-Roy Morgan Consumer Confidence index reveals a halt in its upward trajectory, plunging 4.5 points from its peak two and a half years ago. Recent data highlights a 1.6-point nosedive last week, positioning confidence at a nine-week low, despite the RBA's expressed comfort with the inflation forecast post their December meeting, potentially setting the stage for early rate adjustments in the upcoming year. The context foresees a potential initiation of rate easing by the RBA in May 2025, with a plausible interim cut in February.

This confidence downturn finds its roots in a notable 7.9-point retreat in the 'time to buy a major household item' metric. The subsequent subindex plunge of 10.6 points over the past fortnight post-Black Friday transactions hints at a possible fine-tuning in year-end spending patterns, mirroring the impact of robust November financial activities.

Against this backdrop, the ANZ-Roy Morgan Consumer Confidence metric recorded a 1.6-point descent to 83.9 in the week concluding on December 15, aligning with the aftermath of the Black Friday retail rush. Despite this setback, Consumer Confidence stands 2.1 points above its year-ago equivalent (81.8) and a point beyond the 2024 weekly average of 82.9, showcasing a resilient posture amidst the prevailing economic fluctuations.

As we look across the country Consumer Confidence profiles vary, with declines in NSW, Victoria, and WA balanced by modest upticks in Queensland and SA. Individual financial sentiments narrate a nuanced tale - 21% of Australians, a 1-point step back, perceive their families as 'better off' financially compared to the previous year, while 49%, similarly down by a point, characterise their present financial status as 'worse off'. Projections for the future hint at a decline, with a 1-point dip in the expectation of 'better off' economic conditions next year.

Looking forward 10% of Australians, (marking a 1-point surge) envision prosperous times for the Australian economy in the coming 12 months, in contrast to 30% (down by 1 point) who anticipate challenging periods ahead. Concurrently, sentiment regarding purchasing major household items reflects a shift, with 25% of Australians, a 5-point drop, perceiving the current moment as a 'good time to buy', while 47%, marking a 3-point increase, think that it is presently a 'bad time to buy'.

As we head into 2025, this nuanced macroeconomic data paints a dynamic challenge for brands striving to resonate with consumers amidst fluctuating confidence levels and economic uncertainties. Uncovering and leveraging these insights strategically can empower businesses to chart pathways towards sustainable growth and consumer engagement in an ever-evolving marketplace.